Home / News / 2024 year in review and 2025 outlook

Latest News2024 year in review and 2025 outlook

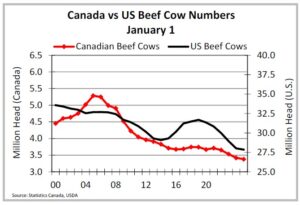

April 8, 2025The last cattle cycle was 14 years. From the 2008 peak to 2015 low was seven years, then from 2015 to the 2022 peak was another seven years. Entering another cattle cycle, it should be remembered that cattle numbers are relatively tighter than the 2022 peak, but there is a long way to go, before revisiting the 2015 low. That will not happen until moisture conditions encourage heifer retention to start. In the last cycle, heifer retention started in the fourth quarter of 2013.

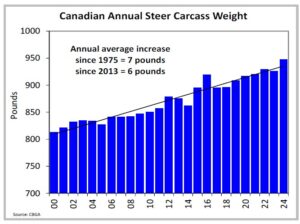

The Canadian cattle herd on January 1st, 2025 was down 0.7% from 2024 with beef cows down 1.2%. Improved moisture in May, reduced cow marketing – this will need to continue to fully stabilize the herd. Unfortunately, the weather outlook is for another dry summer in the west. Beef heifers replacements increased a modest 0.8% but remain below levels needed for stabilization, let alone expansion. The U.S. cattle herd on January 1st, 2025 was down 0.9% from 2024 with beef cows down 1%. As carcass weights increase, the inventory low in every cycle is lower than the previous cycle and the high is lower too. As industry becomes more efficient.

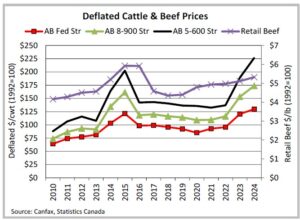

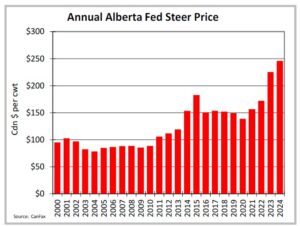

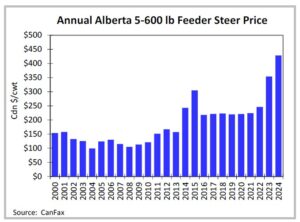

On a deflated basis (1992=100), Alberta fed steer prices were 8% stronger than 2023, moving above their previous high set in 2015. Alberta 550 lb and 850 lb steers also moved above their previous highs. Feeder cattle prices in the last two years have increased more than input costs, supporting cow-calf margins.

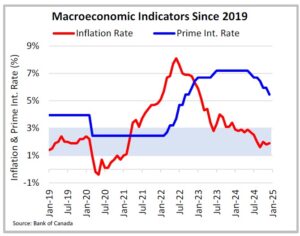

Cuts in the key interest rate in 2024 and 2025 reduced borrowing costs, supporting consumers. However, the unemployment rate is considered to be above the “neutral rate” of 4.9-5.5%. There are 2.4 million more people in the last two years, driven primarily by immigration. The Bank of Canada has forecast GDP growth to be 1.8% in 2025 and 2026. Per capita GDP growth is a major driver of beef consumption and willingness to pay.

Bottom line: The North American cattle herd continues to shrink and smaller slaughter numbers are expected to support prices. Consumer demand was resilient in 2024. US tariffs have the potential to be very disruptive to agricultural markets with volatility driven by uncertainty.

2025 CHALLENGE

The threat of US tariffs on Canadian products remains a concern. On March 7th, there was a pause on the 25% tariff for Mexico and Canadian goods and services covered under CUSMA until April 2nd.

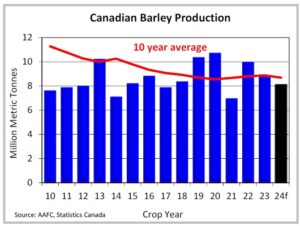

2024/25P BARLEY SUPPLY AND DISPOSITION

- Canadian barley production was 8.1 million metric tonnes in 2024, down 9% from 2023, and down 2% from the five-year average.

- Barley exports in 2024-25 are projected at three million metric tonnes, down 2% from 2023-24. Total domestic use in 2024/25 is projected at 5.7 million metric tonnes, up 3% from 2023-24.

- Ending stocks in 2024-25 are projected at 700,000 metric tonnes, down 39% and projected to be the second smallest on record going back to 1980.

- The stocks-to-use ratio in 2024-25 is projected at 13%, steady with the five-year average.

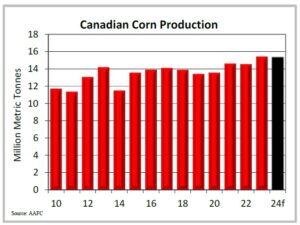

2024/25P CORN SUPPLY AND DISPOSITION

- Canadian corn production was 15.35 million metric tonnes, the second largest on record behind only 2023-24

- Exports in 2024-25 are projected at 2.3 million metric tonnes, up 13% from 2023-24. Total domestic use in 2024-25 is projected at 15.14 million metric tonnes, down 5% from 2023-24.

- Ending stocks in 2024-25 are projected at two million metric tonnes, steady with 2023-24.

- The stocks-to-use ratio in 2024-25 is projected at 13%, compared to the five-year average of 14%.

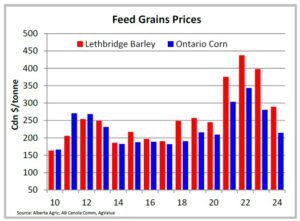

FEED GRAIN PRICES

- Lethbridge barley unevenly declined 16% between January and August, bottoming just prior to the 2024 harvest. Between August and December, Lethbridge barley climbed 15%.

- Lethbridge barley averaged $289/tonne in 2024, down 27% from 2023 and down 16% from the five-year average.

- Lethbridge barley was priced competitively against Alberta oats in 2024, but not against Omaha or Ontario corn.

- Ontario corn was largely rangebound in 2024, with a steady increase noted between July and December.

- Ontario corn averaged $214/tonne in 2024, down 24% from 2023 and down 21% from the five-year average.

- Omaha corn averaged C$232/tonne in 2024, down 26% from 2023 and down 14% from the five-year average.

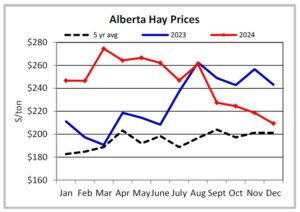

HAY PRICES

- The first half of 2024 saw elevated hay prices in Alberta, driven by dry weather in 2023. Timely rains in the summer of 2024 increased production and reduced prices for the 2024 crop.

- Alberta hay prices averaged $246/ton ($271/tonne), up 8% from 2023 and up 18% from the five-year average.

- Montana hay prices averaged US$137/ton (C$207/tonne) in 2024. This was at a discount to Alberta throughout 2024.

Bottom line: Lower feed prices have supported feeding margins. Ontario corn is still the cheapest feed in North America, followed by Omaha corn. Alberta barley is uncompetitive but by a narrower margin than previous years.

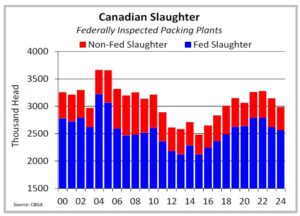

SLAUGHTER

- Domestic (FI) slaughter was 2.99 million head in 2024, down 5%. This was below three million head for the first time since 2017, in part, due to the Cargill Guelph shutdown in June.

- Fed slaughter was 2.56 million head in 2024, down 2%. Non-fed slaughter was 422,000 head in 2024, down 19%.

- Rain in May reduced cow marketings and points to a more stable herd as industry moves into the consolidation phase. Moisture is needed before heifer retention occurs.

CARCASS WEIGHTS

- Steer carcass weights averaged 948 lbs in 2024, 22 lbs heavier.

- Western Canadian steer carcasses averaged 940 lbs in 2024, 23 lbs heavier than 2023. Weights were notably heavier from January to April before being more current in the second half.

- Eastern Canadian steer carcasses averaged 972 lbs in 2024, 21 pounds heavier than 2023, and appeared immune to seasonal trends.

BEEF PRODUCTION

- Domestic beef production declined 2% in 2024, driven by non-fed production which was down 16%. Fed production in 2024 was steady with 2023. Production was supported by heavier carcass weights which offset smaller slaughter numbers.

- Live slaughter exports were up 18.6% at 538 million pounds.

- Total beef production (domestic, live slaughter exports and offals) was up a modest 0.3% at 3.45 billion pounds.

BEEF/CATTLE EXPORTS

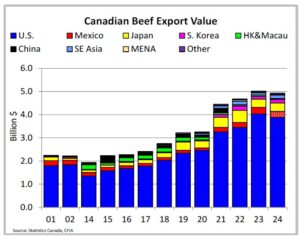

- In 2024 beef exports were down 1% at 495,000 metric tonnes; and down 2% to $4.93 billion, but remain the second largest on record. The top five destinations were the U.S. (76%), Japan (9%), Mexico (6%), South Korea (3%), and Southeast Asia (3%).

- Live cattle exports at 729,000 head in 2024, up 9% from 2023. Fed exports were 20-41% higher to be the largest since 2010, while non-fed exports were 9-12% lower. Feeder exports were down 20% to 103,000 head

BEEF/CATTLE IMPORTS

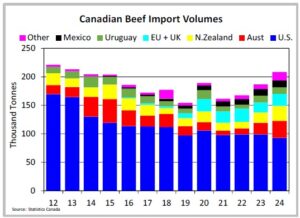

- In 2024, beef imports were up 12% to 208,000 metric tonnes; and up 19% to $2.19 billion.

- Canada’s top five suppliers were the U.S. (45%), Australia (14%), New Zealand (13%), the EU and U.K. (10%). Uruguay and Mexico (6%) share fifth place.

- In 2024, feeder imports were up 24% to 356,500 head, the second largest after 2021. Leaving Canada a net feeder importer by 253,000 head fully offsetting the smaller calf crop with larger fourth quarter imports.

Bottom line: Domestic beef production in 2025 is projected to be steady to slightly smaller, depending on carcass weights. With live slaughter exports projected to be higher, assuming US tariffs are not applied. Imports are anticipated to remain historically large in 2025.

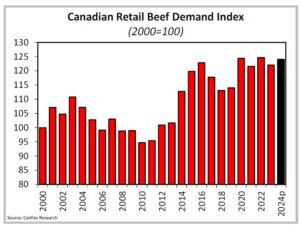

DEMAND

- Beef demand remains historically strong. Retail beef demand is projected higher in 2024 supported by stronger deflated retail prices and modest reductions in per capita consumption.

RETAIL PRICES/CONSUMPTION

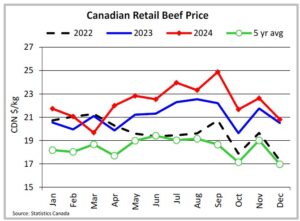

- Nominal retail beef prices in 2024 were 6% higher in 2024 and 21% higher than the five-year average; deflated prices were 4% and 10% higher respectively.

- Deflated pork retail prices were 1% lower in 2024, with deflated retail chicken prices 7% lower.

- The beef-to-pork price ratio averaged 2.31:1 in 2024, the beef-to-chicken price ratio averaged 2.39:1

- Per capita meat consumption (including seafish) increased 4% in 2023 to 80 kg/person. Per capita beef consumption in 2023 averaged 16.2 kg/person, down 7% from 2022. Subsequently, beef market share was 25%, down from 28% in 2022. A growing population and tighter North American supplies are pressuring per capita consumption.

FED PRICES

- Alberta fed steers averaged $246/cwt in 2024, 9% stronger with seasonal trends. Ontario fed cattle prices were 6-10% stronger.

- On a deflated basis, Alberta fed steers were up 8% from 2023 with Ontario fed steers up 6%.

- The Alberta-to-Nebraska cash basis averaged -$12/cwt in 2024, $3/cwt stronger than 2023 but $4/cwt weaker than the five-year average.

- Feedlot margins in 2024 were estimated to be negative on average for most classes of cattle with the exception of steer calves and shortkeep steers.

FEEDER PRICES

- In 2024, Alberta 550 lb steer calves averaged $429/cwt, 21% higher than 2023, Ontario steer calves averaged $412/cwt, up 26%, and U.S. steer calves averaged C$424/cwt up 21%. During the fourth quarter, a six percent weakening of the Canadian dollar supported feeder prices along with a stronger futures market and tight supplies.

- In 2024, Alberta 550 lb steer calves averaged a $16/cwt premium to Ontario calves and a $5/cwt premium to the U.S.

- In 2024, Alberta 850 lb steers averaged $331/cwt 16% stronger than 2023 with Ontario at $335/cwt and the U.S. at C$326/cwt. In 2024, Alberta 850 feeder steers were at a $4/cwt discount to same-weight Ontario steers but were at a $5/cwt premium to the U.S.

Bottom line: In the first quarter of 2025, feeder prices remain strong with fundamental support. However, there are also expectations of stronger prices in the second half of the year as supplies tighten. Market volatility is expected throughout 2025 with an ongoing trade war. Livestock Price Insurance provides a price floor, protecting against downside risk, while leaving the upside open.