What is Livestock Price Insurance?

Livestock Price Insurance (LPI) is a business risk-management program where producers purchase price protection on livestock in the form of an insurance policy. LPI is available in British Columbia, Alberta, Saskatchewan, and Manitoba and provides producers with protection against unexpected drops in prices over a defined period of time.

Check out the detailed information about the Livestock Price Insurance program in our program guide.

Why use Livestock Price Insurance?

LPI allows livestock producers in Western Canada to effectively manage their risk. Cattle and hog producers in Western Canada face volatile market prices. LPI is designed to be market-driven to reflect the risks these producers face.

LPI offers protection from the following risks:

|

LPI is the only tool available in Canada that covers all three price risks producers face, in one package. Protection against unknown market fluctuations gives producers peace of mind.

How does it work?

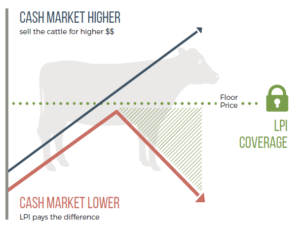

Producers pay a premium to receive forward price coverage. If the market price falls below the insured index (coverage price) in the time frame selected, the producer receives a payment. When a producer purchases coverage, a floor price within the market is established. In the final four weeks of the policy, if the market falls below the insured index (coverage price) purchases, LPI will pay the difference. If the market is above the insured index (coverage price) purchased, producers can benefit by selling livestock into the higher regional market.

Price Insurance Steps

-

- The producer purchases insurance based on the expected sale weight.

- The producer matches the policy length to the time period when the sale of the insured cattle is expected.

- The producer chooses coverage and pays the premium.

- The producer now has a protected floor price.

In the Calf, Feeder and Fed programs, if the cash market is below the selected coverage during the last four weeks of a policy, the producer can make a claim.

In the Hog program, if the cash market is below the selected coverage at the expiration of a policy, the producer can make a claim.

There is no obligation to sell livestock when the policy expires.

Available Products

- LPI – Calf

- LPI – Feeder

- LPI – Fed

LPI – Fed Cattle Price Reporting option enables producers to report their cash prices directly to LPI to benefit the settlement index and sustainability of the program. - LPI – Hog

Who is eligible?

Participation is voluntary and is available to cattle and hog producers in western Canada.

| General Eligibility Requirements

In order to be eligible for LPI, producers must meet the following criteria:

|