The Livestock Price Insurance – Hog was developed with the aim of enhancing Western Canadian hog producers’ ability to manage price volatility in the hog market. LPI offers a risk management alternative to futures and options, with a highly transparent, fixed cost to the producer. There is no minimum weight to insure; it is a tool available to both large and small producers. Participation is voluntary and flexible, allowing producers to tailor coverage to their own operations and risk preferences.

Features of LPI-Hog Price Insurance

LPI insured indexes (coverage prices) are calculated based on market data on each given day.

LPI – Hog includes three indices for coverage. An Alberta index is based off of Red Deer, a Saskatchewan index is based off of Brandon, SK and a Manitoba index is based off of Brandon, MB. These indices are geographically representative for the producers selling to these slaughter facilities.

The forward price is calculated using the Chicago Mercantile Exchange’s (CME) lean hog future with a cash-to-futures basis adjustment. This price is then converted to a western Canadian equivalent price by a forward exchange rate and a western Canadian factor.

Coverage Factors

1. CME Lean Hog Futures

The nearby futures contract for each policy length is used to calculate a forward U.S. price for hogs.

2. Basis

The basis is calculated as the five-year-average of the appropriate local U.S. region-to-CME basis.

3. Canadian Dollar

A forward currency exchange is used to convert the forward U.S. hog price into Canadian currency.

4. Factor

Values from the appropriate plant are used to reflect the difference between the market conditions in western Canada and the United States.

By considering each of these factors, producers have market-driven, forward-price coverage to help manage the risk of marketing hogs.

The table below summarizes the three indices available for LPI – Hog and their data sources.

| Plant/Formula Name | Location | USDA Report | Geographic Scope of USDA Report | Comments |

| Olymel/WHE | Red Deer, AB | LM_HG218 | Iowa/Minnesota | Dominant pricing formula in AB |

| Maple Leaf/Signature 3 Contract | Brandon, MB | LM_HG218 | Western Cornbelt | For SK producers selling to Brandon plant |

| Maple Leaf/Signature 4 Contract | Brandon, MB | LM_HG201 | National | For MB producers selling to Brandon plant |

Settlement

LPI – Hog settlement price is a monthly averaged formula price. It is calculated using the appropriate daily hog price, USD to CAD exchange rate and the appropriate factor.

LPI – Hog settlement price is available on the first business day of each month and is calculated based on data from the previous month.

Settlement IndexThe index is calculated by:

The calculation of the LPI – Hog settlement price is a two-step process:

|

Settling a Claim

LPI – Hog settlement price is published publicly at the beginning of the month and will automatically settle out the policy.

There is no requirement for the producer to sell their hogs at the time the policy expires. While the intent of the program is to match coverage with hog marketing timelines, there is no requirement to market hogs before the policy expires.

Hog Purchase and Settlement Example

Tom is an Alberta-based hog producer who is looking to insure 200 finished hogs. Tom plans on selling his hogs in western Canada. He sees that he has the option to insure off of 3 geographically based Index tables.

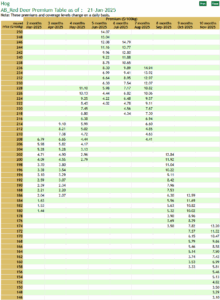

Tom selects AB_Red Deer as his intention is to sell in Alberta. Tom would like to know how much it will cost him and how much coverage he will have. Tom has an expected sale time as August. His finished dressed weight for hogs is 220lbs (approx. 100kg).

**This is a sample premium only and does not constitute an offer to sell insurance coverage.**

Tom plans to market 200 hogs in August and is looking at buying an August 2025 policy from the AB_Red Deer table.

200 head x 100 kg = 20,000 kgs or 20,000kg / 100kg = 200ckgs of insured hogs

200ckgs x Premium $14.94/ckg = $2,988.00 cost to insure

Tom would also like to know how his settlement works.

Let us assume August has come around and the Settlement price is $222. The settlement price is below the insured price purchased resulting in an indemnity owed to the Tom.

= 200ckg x (Insured Index of $236 – Settlement value of $222)

= 200ckg x $14

= $2,800

* No Indemnity Owed = If the settlement value is higher than the Insured Index Tom will not receive a payment.