The calf product is offered in the spring and covers the price risk a cow-calf producer faces selling calves in the September to February markets.

Features of LPI Calf Price Insurance

| Eligible Animal Types | Beef heifers and steers |

| Purchase Availability | February – June |

| Purchase Deadline | Second Thursday in June |

| Policy Lengths | 16 to 36 weeks |

| Coverage Level Range | 95% – 75% of the expected forward price for each policy length |

| Minimum Weight Requirements | No weight minimums |

| Regional Settlement Indexes | Alberta – Settlement index based off Alberta markets SaskMan – Settlement index based off Saskatchewan and Manitoba markets |

| Data Collected for Coverage and Settlement Calculations based on | 550-650 lb steers |

| Settlement Index Representative of | Average 600 lb steer |

| Claim Window | 4 weeks* |

* Policies nearing the end of a blackout period are not guaranteed four weeks of claim. Producers can reference the Calendar of Insurance to ensure they select a policy with the appropriate claim window.

Coverage

LPI – Calf program is market-driven, using several factors to forecast a future calf price. During the policy purchase period, coverage offered is calculated on Tuesdays, Wednesdays and Thursdays using market data from each given day.

Coverage Factors

1. Chicago Mercantile Exchange (CME) feeder cattle futures

The nearby futures data for each policy length is used to calculate a forward U.S. price of feeder cattle.

2. Canadian dollar

Forward currency exchange is used to convert the forward U.S. feeder price into Canadian currency.

3. Basis

- The Canadian valued forward price is adjusted for basis which involves the historical, current, and future market conditions.

- The basis is calculated for the policy’s expiry week by comparing a three-year historical average of the feeder cattle price settlement index to a three-year historical average of the CME feeder cattle nearby futures.

- This calculation assumes the basis will eventually return to the three-year average but also takes into account the current cash to futures basis.

4. Feeder to calf spread

A spread is calculated by subtracting the feeder price from the calf price. The current spread is compared to the five-year-average spread for the policy length being purchased.

5. Spot barley price (Lethbridge)

The current price of barley is compared to the five-year-average price of barley.

By considering each of these factors, producers have market-driven, forward-price coverage to help manage the risk of marketing calves September through February.

Settlement

The LPI-Calf program creates a settlement index based on weekly data collected from from electronic and auction market sales across western Canada. From this data, a settlement index is made publicly available on the following Monday (Tuesday when Monday is a statutory holiday).

Settlement IndexThe settlement index is representative of the average price of a 600 pound steer in any given week. The index is calculated by:

*Auction market sales data will not be disclosed due to contractual obligations. |

Calf Purchase and Settlement Example

Example: Calf Purchase

Doug has 150 calves that he is going to Market in November, they will average 650lbs.

150 head*650lbs = 97,500lbs or 975cwt to insure.

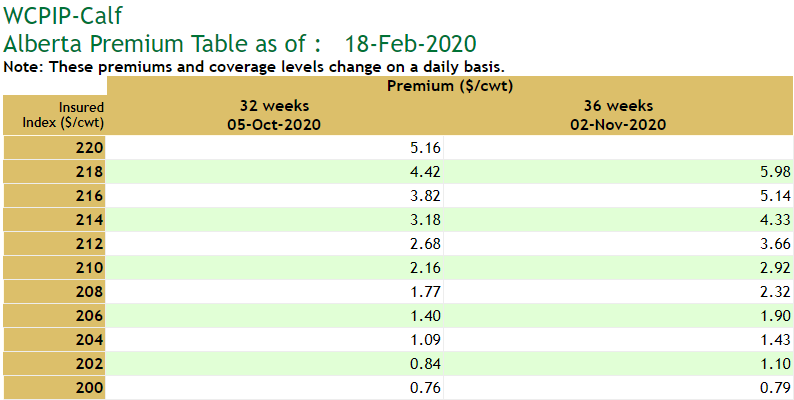

Doug wants at least $2/lbs ($200/cwt). On February 18, 2020 LPI offered coverage of $218/cwt for a premium of $5.98/cwt. Doug is covered against a market decline into November of 600 lb steer calves falling below $218/cwt

$5.98/cwt*975cwt = $5,830.50 total premium

$5,830.50/150 head = $38.87/head

Example: Calf Settlement

Doug has coverage of $218/cwt on his calves for November 2, 2020. As Doug’s claim window draws near, he begins to watch the settlement indexes.

During Doug’s four week claim window of October 12 – November 2; the settlement price dropped below his coverage price for all four weeks in his window. Doug felt prices would continue to come down during his window, so he decided to claim a portion of his policy on October 26 and let the remaining amount settle on November 2.

If the settlements within his claim window were higher than his insured index of $218/cwt, there would be no payout.

| Date | Settlement / CWT |

| October 12 | $210.51/CWT |

| October 19 | $204.94/CWT |

| October 26 | $197.58/CWT |

| November 2 | $196.99/CWT |

Doug claimed half of his policy on October 26

$218/cwt – $197.58/cwt = $20.42

$20.42 * 487cwt = $9,944.54 indemnity payment

Doug left the other half of his policy to expire on November 2

$218/cwt – $196.99/cwt = $21.01

$21.01 * 488cwt = $10,252.88 indemnity payment