Home / News / 2023 year in review and 2024 outlook

Latest News2023 year in review and 2024 outlook

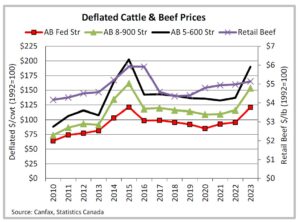

March 25, 2024Feed grain prices moderated throughout 2023, supporting feeder prices. On a deflated basis (1992=100) most classes of feeder and fed cattle in Alberta and Ontario approached previous all-time high prices. Domestic beef production declined 5 per cent, as drought across North America over the last three years moved heifers into feedlots. Beef export volumes declined slightly; but values were record high. Cattle inventories are expected to be smaller in 2024, providing fundamental support to cattle prices. Larger beef imports are anticipated to fill the void with shrinking North American beef production.

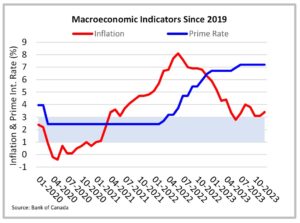

The Canadian economy appears to have stabilized by the end of 2023 with current numbers (1.5 per cent GDP growth) outpacing original expectations (1 per cent). Inflation is moderating and economists are expecting interest rate cuts to begin mid-year. The Canadian Dollar averaged near US$0.74 in 2023.

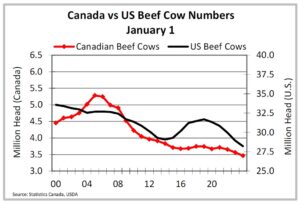

North American cattle inventories are driven by the U.S. herd. The U.S. cattle herd on January 1st, 2024 was down 1.9 per cent from 2023, to 87.2 million head, beef cows were down 2.5 per cent to 28.2 million head, and beef breeding heifers were down 1.4 per cent to 4.9 million head. Smaller numbers have been offset by larger carcass weights. The Canadian cattle herd was down 2.1 per cent to 11.1 million head as of January 1st, 2024, beef cows were down 2.4 per cent to 3.46 million head and beef breeding heifers were down 5.6 per cent to 519,600 head. North American heifer retention, thought to begin in 2023, will be delayed until at least the fall of 2024, subject to adequate moisture.

Bottom line: Ongoing drought conditions continue to delay the expansion phase of the cattle cycle. A smaller North American beef herd in 2024 will reduce beef production, supporting prices throughout the supply chain. It remains to be seen how consumer demand holds up in 2024.

2023 MACROECONOMIC OVERVIEW

- The inflation rate declined from 5.9 per cent in January 2023 to 3.4 per cent by December 2023, though the ride has been bumpy

- The prime interest rate rose from 6.7 per cent in January to 7.2 per cent by December to combat higher inflation. The interest rate has been steady since July 2023

- The unemployment rate was 5 per cent in January, but slowly and inconsistently increased to 5.8 per cent by December 2023

- The Canadian economy outpaced expectations in 2023, re-igniting the possibility of a ‘soft landing’ in 2024

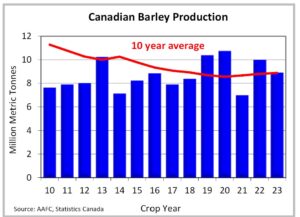

2023/24P BARLEY SUPPLY AND DISPOSITION

- Canadian barley production totaled 8.9 million metric tonnes, 11 per cent lower than 2022, and steady with the 10-year average

- Barley exports in 2023/24 are projected at 2.78 million metric tonnes, down 28 per cent from 2022/23

- Total domestic use in 2023/24 is projected at 5.91 million metric tonnes, 1 per cent lower than 2022/23

- Ending stocks in 2023/24 are projected at one million metric tonnes, 41 per cent higher than 2022/23

- The stocks-to-use ratio in 2023/24 is projected at 17 per cent, compared to the five-year average of 12 per cent

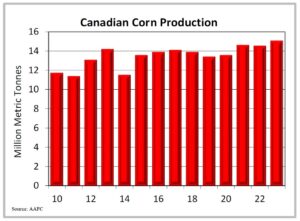

2023/24P CORN SUPPLY AND DISPOSITION

- Canadian corn production totaled 15.08 million metric tonnes, the largest on record and 4 per cent higher than 2022

- Exports in 2023/24 are projected at 2.85 million metric tonnes down 35 per cent from 2022/23

- Total domestic use in 2023/24 is projected at 15.45 million metric tonnes, 4 per cent higher than 2022/23

- Ending stocks in 2023/24 are projected at 1.9 million metric tonnes, 17 per cent higher than 2022/23

- The stocks-to-use ratio in 2023/24 is projected at 12 per cent, lower than the 10-year average of 15 per cent

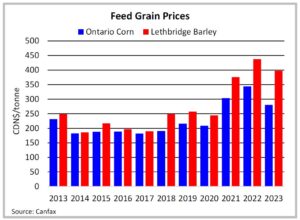

FEED GRAIN PRICES

- Feed grain prices steadily declined in 2023. Between January and December 2023, barley prices dropped 26 per cent, Ontario corn prices dropped 32 per cent

- China’s trade action against Australia was lifted in August 2023, reducing demand for Canadian barley

- New crop (2023/24) barley and corn prices were considerably lower compared to old crop (2022/23) prices

- Lethbridge barley averaged just shy of $400/tonne, a 9 per cent reduction from 2022, but was still priced at a premium to all feed grain substitutes

- Ontario corn averaged $281/tonne, down 18 per cent from 2022

- Omaha corn averaged C$312/tonne, down 16 per cent from 2022

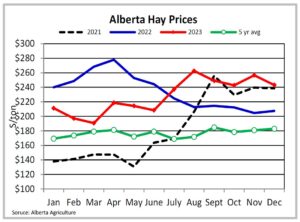

HAY PRICES

- Drought conditions in Western Canada pushed hay prices higher in 2023. Second half 2023 Alberta hay prices were priced at a premium compared to the first half.

- Alberta hay prices averaged $228/ton ($251/tonne) in 2023, down 3 per cent from 2022

- Montana hay prices averaged US$212/ton (C$315/tonne), down 13 per cent from 2022. In the second half of 2023, Montana hay prices moved lower to a discount compared to Alberta

Bottom line: Barley production in 2024/25 is forecast to increase 4 per cent from 2023/24. Corn production is forecast to decrease 5 per cent but will still be the fourth highest on record. Feed input prices are expected to moderate in 2024.

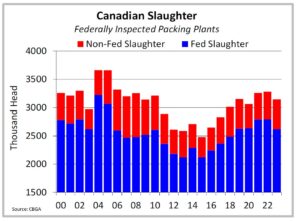

SLAUGHTER

- Canadian slaughter (FI only) totaled 3.14 million head in 2023, down 4 per cent, supported by non-fed animals

- Fed slaughter totaled 2.62 million head in 2023, down 6 per cent. Non-fed slaughter totaled 523,144 head in 2023, up 8 per cent (cows +7 per cent; bulls +28 per cent)

- Total slaughter was down 6 per cent in the west and down 8 per cent in the east. Non-fed slaughter was up 9 per cent in the west; and up 5 per cent in the east

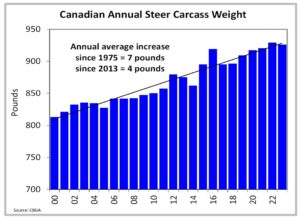

CARCASS WEIGHTS

- Steer carcass weights averaged 926 lbs in 2023, three pounds lighter than 2022

- Western Canadian steer carcasses averaged 917 lbs in 2023, seven pounds lighter than 2022. Steer carcass weights moved to be record heavy in the fourth quarter

- Eastern Canadian steer carcasses averaged 958 lbs in 2023, seven pounds heavier than 2022

BEEF PRODUCTION

- Total domestic beef production in 2023 totaled 2.7 billion pounds, down 5 per cent from 2022. Fed production totaled 2.3 billion pounds, down 7 per cent from 2022. Non-fed production totaled almost 390 million pounds, up 9 per cent from 2022

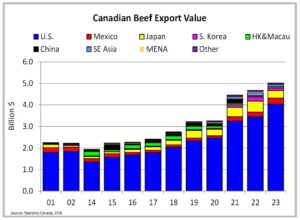

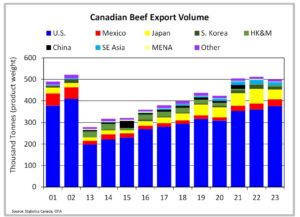

BEEF/CATTLE EXPORTS

- Beef export volumes for 2023 were down 2 per cent from 2022 to 499 million metric tonnes; values were 7 per cent higher at $5.02 billion to be the highest on record

- The top five destinations for Canadian beef by market share are the U.S. (75 per cent), Japan (9 per cent) Mexico (7 per cent), South Korea (3 per cent), and Southeast Asia (3 per cent)

- Live cattle exports totaled 670,000 head in 2023, down 6 per cent from 2022.

- Slaughter export volumes were steady with 2022. Fed steers and heifer exports were 10-13 per cent higher; non-fed exports were 15-16 per cent lower. Feeder export volumes were down 26 per cent in 2023 to just under 130,000 head

BEEF/CATTLE IMPORTS

- Beef import volumes in 2023 were up 11 per cent from 2022 to 186.6 million metric tonnes; import values were up 12 per cent to $1.84 billion

- Canada’s top five suppliers of beef by market share are the U.S. (53 per cent), Australia (11 per cent), New Zealand (10 per cent), the EU and U.K. (9 per cent). Uruguay and Mexico (6 per cent) share fifth place

- In 2023, feeder import volumes were 2 per cent lower than 2022; leaving Canada a net importer of feeder cattle by almost 160,000 head

Bottom line: Domestic beef production is projected to have a smaller decline in 2024, compared with what was seen in 2023.

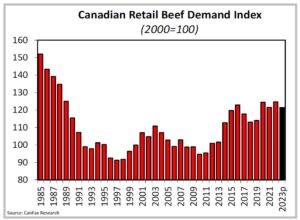

DEMAND

- Domestic demand declined slightly in 2023, driven by reduced supplies but remained historically high, at levels comparable to the late 1980s

- The international beef demand index increased in 2023 to be the highest on record

- Beef market share as a percent of total protein consumption in 2022 was steady with 2021 at 29 per cent

RETAIL PRICES/CONSUMPTION

- Nominal retail beef prices in 2023, were on average 7 per cent higher than 2022; deflated prices were 3 per cent higher

- Deflated retail prices for pork and chicken were 8 per cent and 0.4 per cent lower respectively

- The beef-to-pork price ratio averaged 2.2:1 in 2023, the beef-to-chicken price ratio averaged 2.14:1

- Per capita meat consumption (including seafish) increased 4 per cent in 2022 to 80 kg/person

- Per capita beef consumption in 2022 averaged 17.5 kg/person, up 3 per cent from 2021

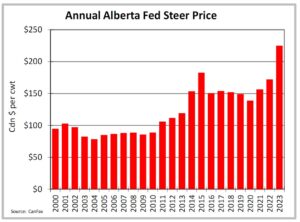

FED PRICES

- Fed cattle prices in both Alberta and Ontario peaked in June 2023, as feedlots moved to be very current

- Alberta fed cattle were 29-31 per cent stronger in 2023 compared to 2022; Ontario fed cattle were 24-27 per cent stronger (nominal prices)

- Deflated Alberta fed steer prices matched their previous all-time highs set in 2015

- The Alberta-to-Nebraska cash basis averaged -$14/cwt in 2023, the third weakest on record

- Feedlot margins were estimated to be positive on average for 2023, but dipped negative in December

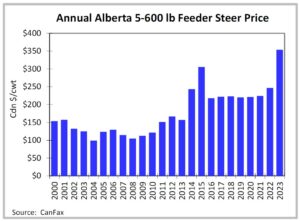

FEEDER PRICES

- Alberta and Ontario feeder steer prices continuously strengthened from January to September, setting new all-time highs (nominal) as the fall run began

- Alberta steers under 700 lbs were 41-47 per cent stronger than 2022; steers 700 lbs and over were 34-39 per cent stronger

- Ontario steers under 700 lbs were 35-36 per cent stronger than 2022; steers 700 lbs and over were 32-35 per cent stronger

- Alberta 550 lb steers were consistently at a premium to Ontario, averaging a $26/cwt premium in 2023

- Alberta 850 lb steers were inconsistent against the Ontario market, but averaged a $2/cwt premium in 2023

- Deflated Alberta 550 lb and 850 lb steer prices were 6 per cent and 5 per cent respectively below their all-time highs set in 2015; Ontario steers were 10 per cent and 3 per cent below 2015

Bottom line: Prices continue to have fundamental supply support. Given volatility sone the fourth quarter of 2023, producers should remember that Livestock Price Insurance protects against downside risk while leaving the upside open.