Home / News / Protecting your bottom-line with LPI

Latest NewsProtecting your bottom-line with LPI

June 10, 2025For cattle producers, taking calves to market is always a calculated risk. Prices can shift overnight due to factors beyond your control—weather, trade uncertainty, feed costs, and more.

The last thing you want is to see your profits disappear because of a sudden market downturn. Protecting your bottom line with Livestock Price Insurance (LPI) is one way to manage your risk and gain peace of mind in an unpredictable market.

With LPI, cow-calf producers reduce price risk and protect against market volatility by buying price insurance for calves they plan to sell between September and February.

Calf price insurance is available for purchase each year from February into June. For 2025, the last day to buy calf insurance is June 12.

“Some farmers think of calf insurance as a bonus cheque and that’s not the way to use it. It’s a way to insure your bottom price to enable you to market your calves better. I know the year I didn’t have calf insurance I was pretty nervous all summer and maybe made some bad marketing decisions. When you have that, you know absolutely what your bottom is for your calf crop and the skies the limit from there. You can market them. You can hold them. I think the secret to the insurance program is the ability to market and to have peace of mind.”

– Chris Sloan, Sloan Cattle Company

Managing risk through trade uncertainty

With ongoing trade uncertainty, producers are taking steps to ensure their bottom-line is protected.

LPI has seen increasing sales this year, as producers choose to protect their planned livestock sales.

In comparison to last year, calf insured units for April are up 43.6 per cent. Overall, there has been a 66 per cent increase in clients purchasing calf, feeder, and fed policies.

Trends show that producers are choosing the highest coverage available when buying calf policies, with 73 per cent of calf purchases using the top coverage for the corresponding policy length.

The most popular expiry dates for calf policies are later October.

Protecting your bottom-line

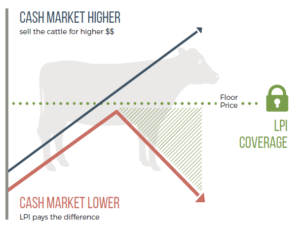

LPI helps cattle and hog producers manage financial risks by providing a buffer against market volatility.

If market prices fall below the insured level, producers receive a payout to cover the difference.

Setting a floor price provides producers with stability so they can plan their operations with more certainty, knowing they have a guaranteed minimum revenue.

Producers can choose different coverage options and policy lengths based on futures markets, with varying premium levels. This flexibility helps you tailor the insurance to your specific needs and market conditions.

Sign up for LPI Premium and Settlement emails to help you monitor the premium tables and keep up to date on market fluctuations.

If you have questions or would like more information, please contact your provincial Livestock Price Insurance office.